In today’s financial landscape, efficiency, accuracy, and customer satisfaction are paramount. One key technological advancement that has revolutionized the lending industry is Loan Origination Software (LOS). This powerful tool not only streamlines the loan process but also enhances the borrower experience, ensuring lenders can stay competitive in a demanding market. In this blog, we’ll delve deep into what LOS is, its features, benefits, implementation challenges, and future trends.

Partnering with Internet Soft, a leading software development company in California can provide you with the expertise and innovative solutions needed to achieve your goals.

Understanding Loan Origination Software (LOS)

Loan Origination Software (LOS) is an integrated platform designed to manage the end-to-end process of loan origination, from application to disbursement. This software automates and streamlines the various stages involved in processing loans, including data entry, credit analysis, underwriting, document management, and compliance checks

Ready to take your Android app to the next level?

Hire Android Developer now and let’s build something amazing together!

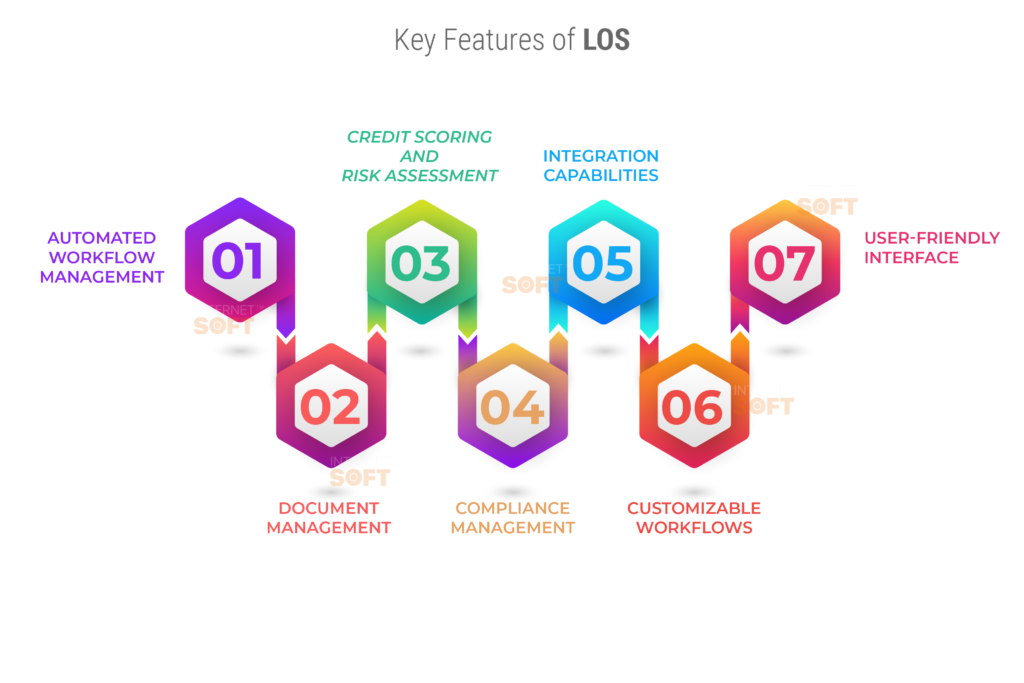

Key Features of LOS

Automated Workflow Management

LOS platforms typically come with workflow automation, which helps in managing and streamlining various steps in the loan origination process. Automation reduces manual intervention, minimizes errors, and speeds up processing times.

Document Management

A robust LOS includes comprehensive document management capabilities, allowing for secure storage, retrieval, and sharing of necessary documents. This feature ensures that all documentation is accurate, up-to-date, and easily accessible.

Credit Scoring and Risk Assessment

Advanced LOS systems integrate with credit bureaus and utilize sophisticated algorithms to assess the creditworthiness of applicants. This helps in making informed lending decisions quickly and accurately.

Compliance Management

Regulatory compliance is a critical aspect of the lending industry. LOS platforms come with built-in compliance management tools to ensure that all loan origination processes adhere to the latest regulatory standards.

Integration Capabilities

Effective LOS systems offer seamless integration with other financial systems, such as core banking platforms, Customer Relationship Management (CRM) systems, and third-party services like credit bureaus and e-signature providers.

Customizable Workflows

Since lending processes can vary significantly between different types of loans and institutions, LOS platforms offer customizable workflows to suit the specific needs of different lenders.

User-Friendly Interface

A user-friendly interface is essential for ensuring that both staff and customers can navigate the system with ease, reducing training time and improving overall efficiency.

Benefits of Implementing LOS

- Increased Efficiency and Speed

By automating various stages of the loan origination process, LOS significantly reduces the time required to process loan applications. This allows lenders to handle a higher volume of applications with the same resources, ultimately leading to increased profitability.

- Enhanced Accuracy and Reduced Errors

Manual data entry is prone to errors, which can lead to costly mistakes and delays. LOS minimizes human error by automating data collection and processing, ensuring accuracy and consistency throughout the loan origination process.

- Improved Customer Experience

A streamlined, efficient loan application process translates to a better experience for borrowers. Faster processing times, transparent communication, and easy access to necessary documents enhance customer satisfaction and loyalty.

- Better Risk Management

With integrated credit scoring and risk assessment tools, LOS enables lenders to make more informed decisions, thereby reducing the risk of defaults and improving the overall quality of their loan portfolios.

- Regulatory Compliance

Staying compliant with ever-changing regulations is a major challenge for lenders. LOS systems are designed to automatically update and adhere to the latest regulatory requirements, reducing the risk of non-compliance and associated penalties.

- Cost Savings

By increasing operational efficiency and reducing the need for manual labor, LOS can lead to significant cost savings. Additionally, minimizing errors and improving compliance can prevent costly legal issues and fines.

Challenges in Implementing LOS

Despite the numerous benefits, implementing Loan Origination Software can pose certain challenges.

- Integration with Existing Systems

Integrating a new LOS with existing financial systems can be complex and time-consuming. Compatibility issues may arise, requiring additional resources and expertise to resolve.

- Data Migration

Migrating data from legacy systems to a new LOS can be a daunting task. Ensuring data accuracy and integrity during the transfer process is crucial to avoid disruptions in operations.

- User Adoption

Training staff to effectively use the new system is essential for successful implementation. Resistance to change and a steep learning curve can hinder user adoption and affect productivity.

- Customization and Scalability

Finding an LOS that meets the specific needs of an organization can be challenging. Additionally, ensuring that the system can scale with the growth of the business is vital for long-term success.

- Cost of Implementation

The initial cost of implementing an LOS can be high, including software licensing, hardware, training, and ongoing maintenance. Lenders need to weigh these costs against the potential long-term benefits.

Future Trends in LOS

The future of Loan Origination Software is promising, with several trends poised to shape its evolution.

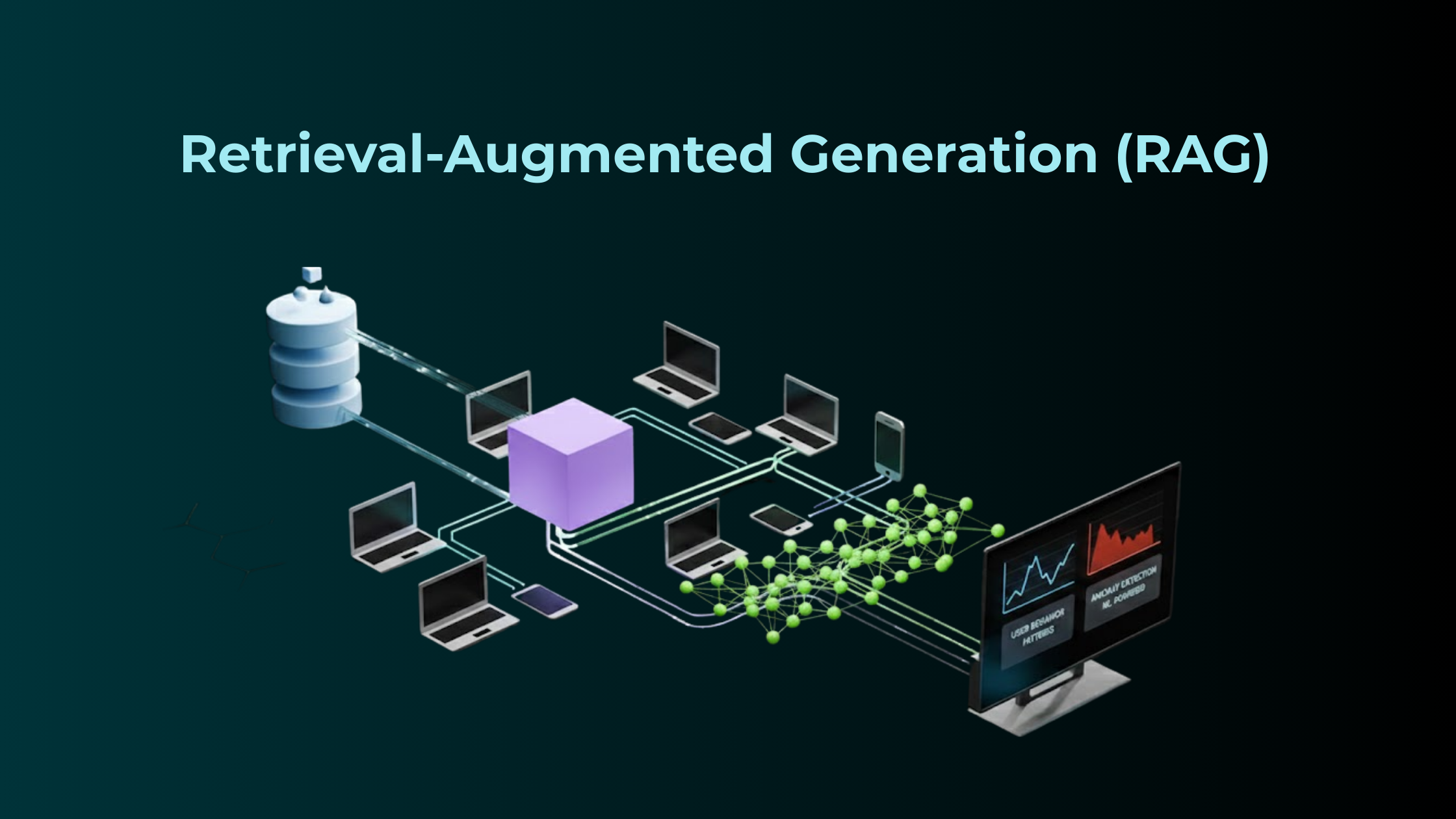

- Artificial Intelligence and Machine Learning

AI and machine learning are set to revolutionize LOS by enabling more accurate risk assessment, predictive analytics, and personalized lending experiences. These technologies can also enhance fraud detection and streamline compliance processes.

- Blockchain Technology

Blockchain has the potential to enhance the security and transparency of the loan origination process. By providing a tamper-proof ledger, blockchain can reduce fraud and improve the efficiency of document verification and data sharing.

- Cloud-Based Solutions

Cloud-based LOS platforms offer greater flexibility, scalability, and cost-effectiveness compared to traditional on-premise solutions. As more lenders move to the cloud, we can expect to see continued innovation and improvements in cloud-based LOS offerings.

- Enhanced Mobile Capabilities

As mobile banking continues to grow, LOS platforms are incorporating more mobile-friendly features. This allows borrowers to apply for loans and manage their accounts from their smartphones, improving accessibility and convenience.

- Increased Focus on Customer Experience

Future LOS platforms will place even greater emphasis on enhancing the customer experience. This includes more intuitive user interfaces, faster processing times, and personalized loan offers based on customer data.

- Regulatory Technology (RegTech)

RegTech solutions integrated with LOS will further streamline compliance management, making it easier for lenders to keep up with regulatory changes and maintain compliance.

Wrapping Up

Loan Origination Software has become an indispensable tool for modern lenders, offering numerous benefits such as increased efficiency, improved accuracy, enhanced customer experience, and better risk management. While there are challenges in implementing LOS, the long-term advantages far outweigh the initial hurdles. As technology continues to evolve, we can expect LOS to become even more sophisticated, incorporating advanced features like AI, blockchain, and enhanced mobile capabilities.

For lenders looking to stay competitive and meet the demands of today’s fast-paced financial environment, investing in a robust LOS is not just an option but a necessity. By embracing the latest trends and overcoming implementation challenges, lenders can leverage LOS to streamline their operations, reduce costs, and ultimately deliver better service to their customers.

If you are in search of an AI development company or a software development company in California that specializes in loan origination software, Internet Soft is your go-to partner. With their expertise and innovative approach, Internet Soft can provide you with customized LOS solutions that enhance efficiency, ensure compliance, and improve customer satisfaction. Choose Internet Soft for a seamless and effective LOS implementation.

Visit Internet Soft for the latest tech trends and insights around AI, ML, Blockchain, along with NeoBanking and timely updates from industry professionals!

Need assistance or have questions? Reach out us at sales@internetsoft.com.

ABOUT THE AUTHOR

Abhishek Bhosale

COO, Internet Soft

Abhishek is a dynamic Chief Operations Officer with a proven track record of optimizing business processes and driving operational excellence. With a passion for strategic planning and a keen eye for efficiency, Abhishek has successfully led teams to deliver exceptional results in AI, ML, core Banking and Blockchain projects. His expertise lies in streamlining operations and fostering innovation for sustainable growth