Trusted By

/ Solution / Telemedicine App Solution

Overview

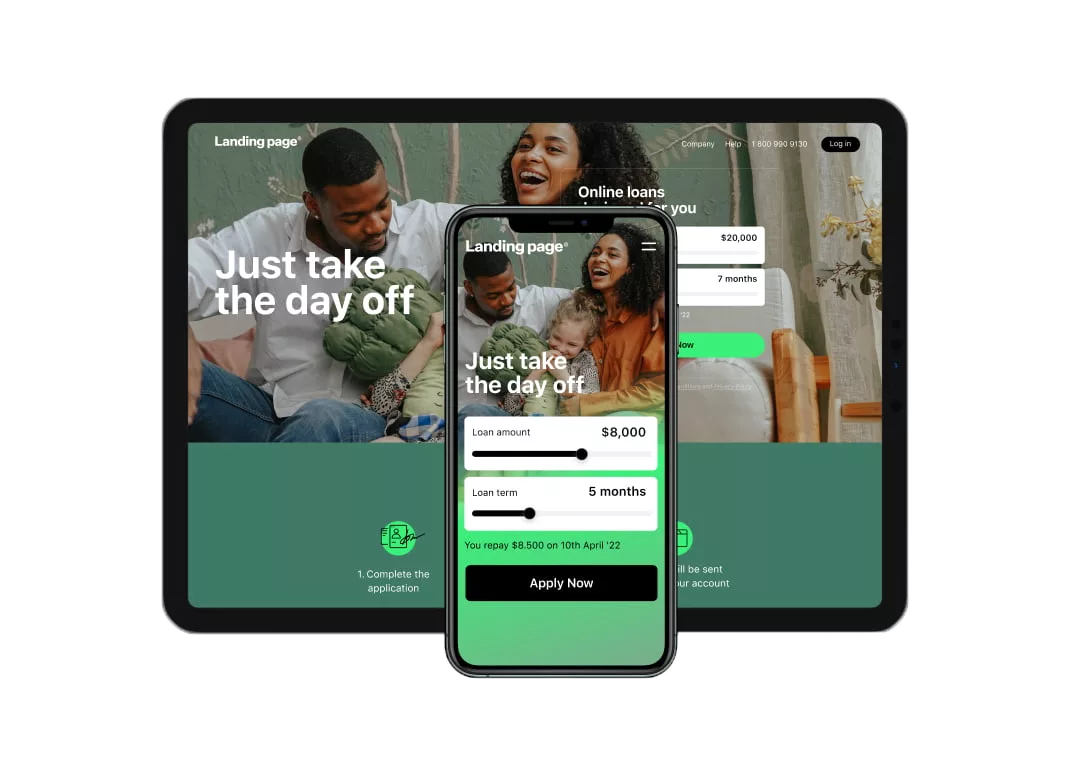

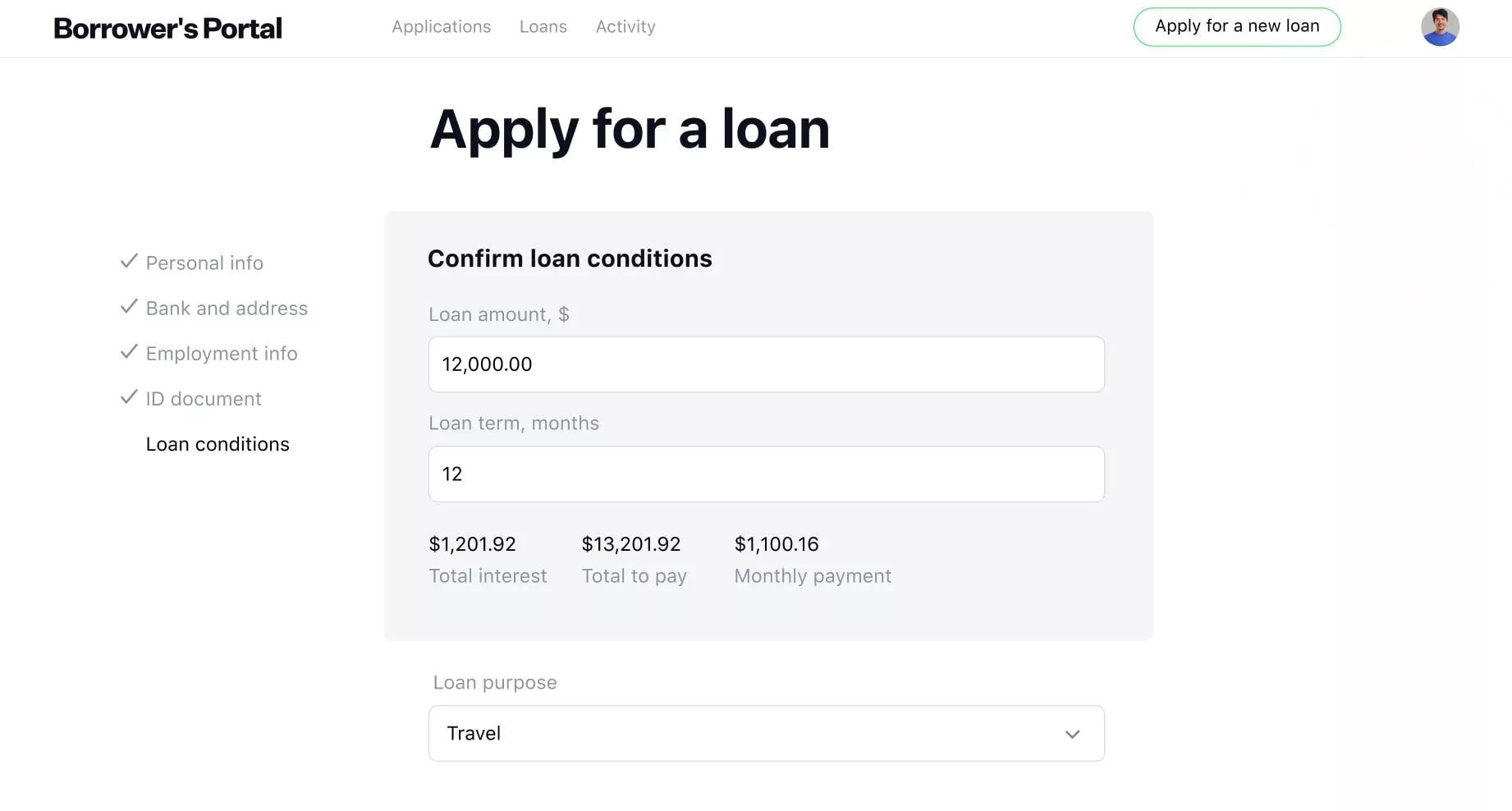

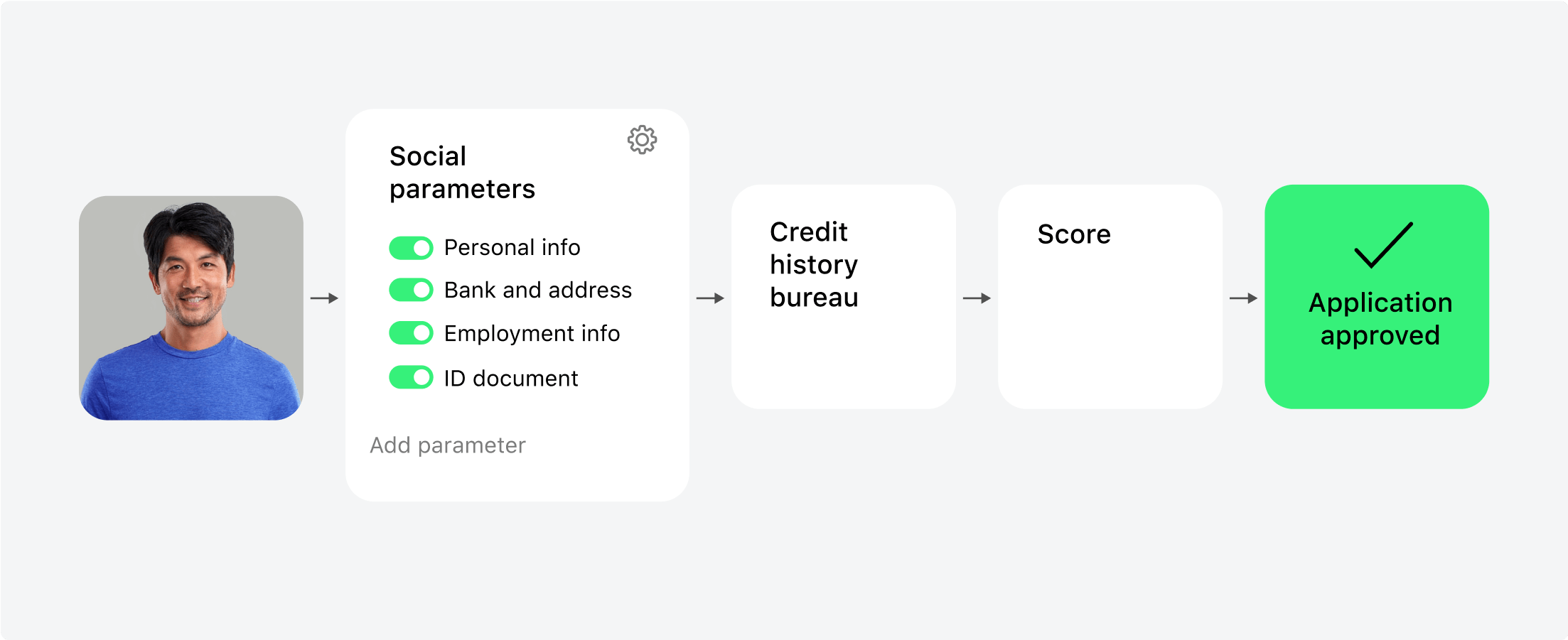

Internet Soft presents a loan origination software (LOS) that helps borrowers obtain loans from lending partners. Our solution helps assess credit scores, minimizes risks, processes documents digitally, and gains appraisal for multiple types of loans across verticals and industries while integrating website, Android, and iOS applications.

Key Features

Borrowers

Borrowers initiate the loan application process through the LOS. They provide essential documentation, such as proof of income, assets, and credit history, to demonstrate their creditworthiness. Borrowers rely on the LOS to submit these documents securely and efficiently, ensuring a smooth application process.

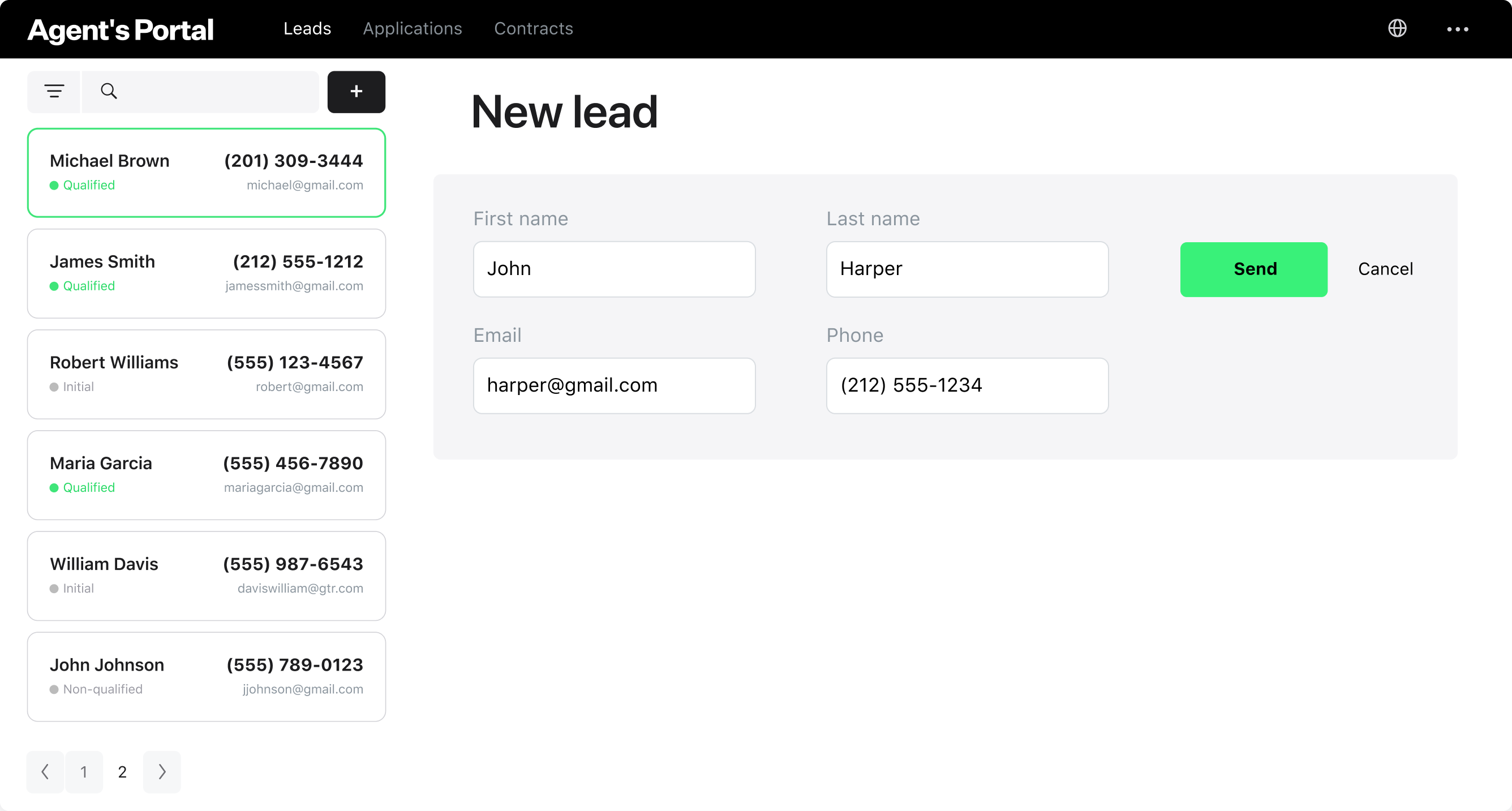

Loan Processors

Loan processors are accountable for verifying the accuracy of documents uploaded by borrowers. They review documents such as bank statements, salary slips, tax returns, and other proof of income and assets on the LOS. They ensure that the information provided aligns with the lender’s requirements and guidelines.

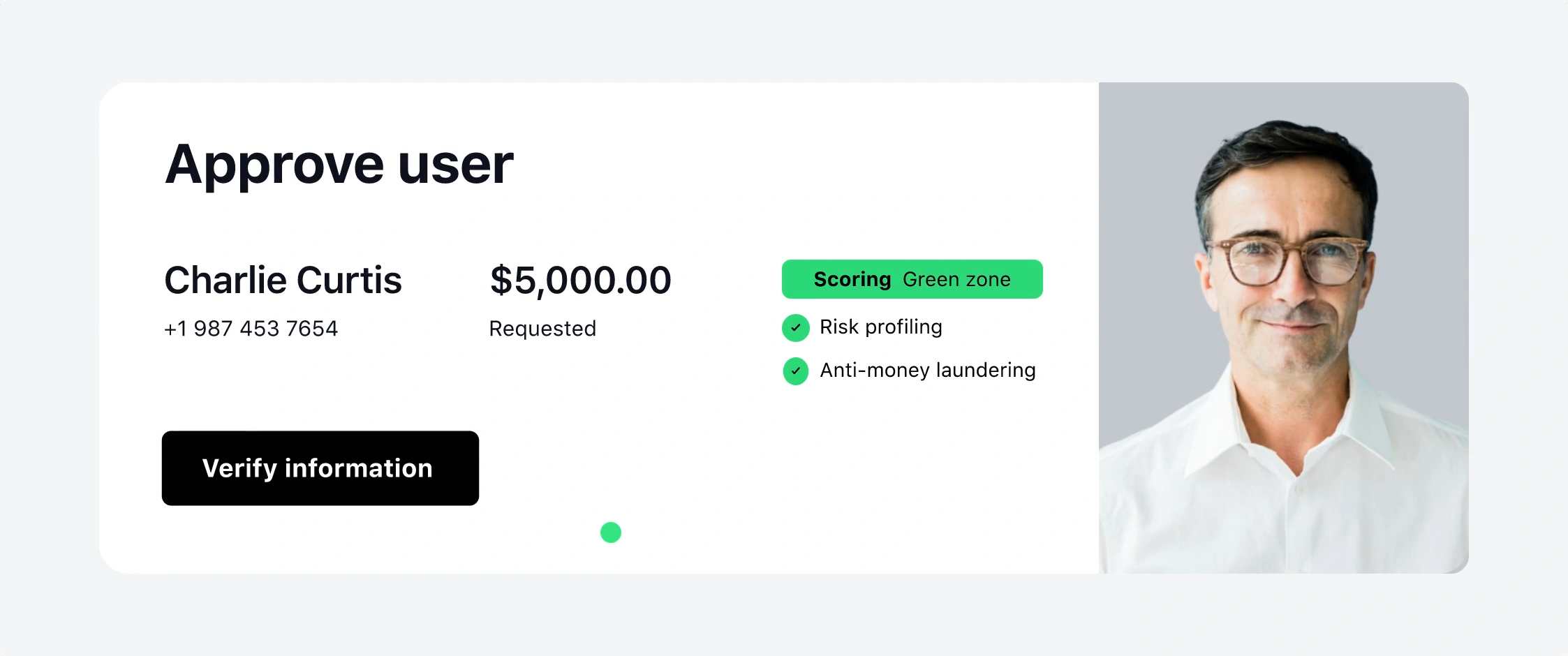

They assess the risk accredited to each borrower and take a call to accept or reject the borrower’s loan application. They work closely with Appraisers to facilitate the appraisal process. Once documents are verified and approved, Loan Processors submit the necessary information to Appraisers for property valuation. They help move the Borrower’s application one step closer to gaining a loan.

Loan Officers

This feature helps with the administration of billing and payment transactions, including the creation and maintenance of payment plans, processing insurance claims, and tracking patient payments and account balances.

Appraisers

Appraisers are responsible for evaluating a borrower’s risk and lending credit to them via loans. To determine their risk and creditworthiness, they assess the Borrower’s properties and assets, outstanding debts, pending loans, employment details, and income statements. This helps limit the bank’s losses in the event of a default payment by the Borrower. After evaluating market trends, they decide on a loan structure, principal, interest rate, and additional charges and file them in the term sheet.

Underwriters

Underwriters evaluate the overall risk associated with the loan application and use the information provided in the Borrower’s application to determine the risk to the lending partner. They conduct research into the Borrower’s credit history and bank statements if the loan favors the financial institution. They ensure that the loan meets regulatory requirements and internal lending guidelines, mitigating risks for the lender. In addition, they determine the premiums paid by the Borrower to ensure banks do not face any financial risks. They can reduce the number of default payments and claims to be processed by the bank. In the end, they undertake the decision to approve or reject the Borrower’s loan application.

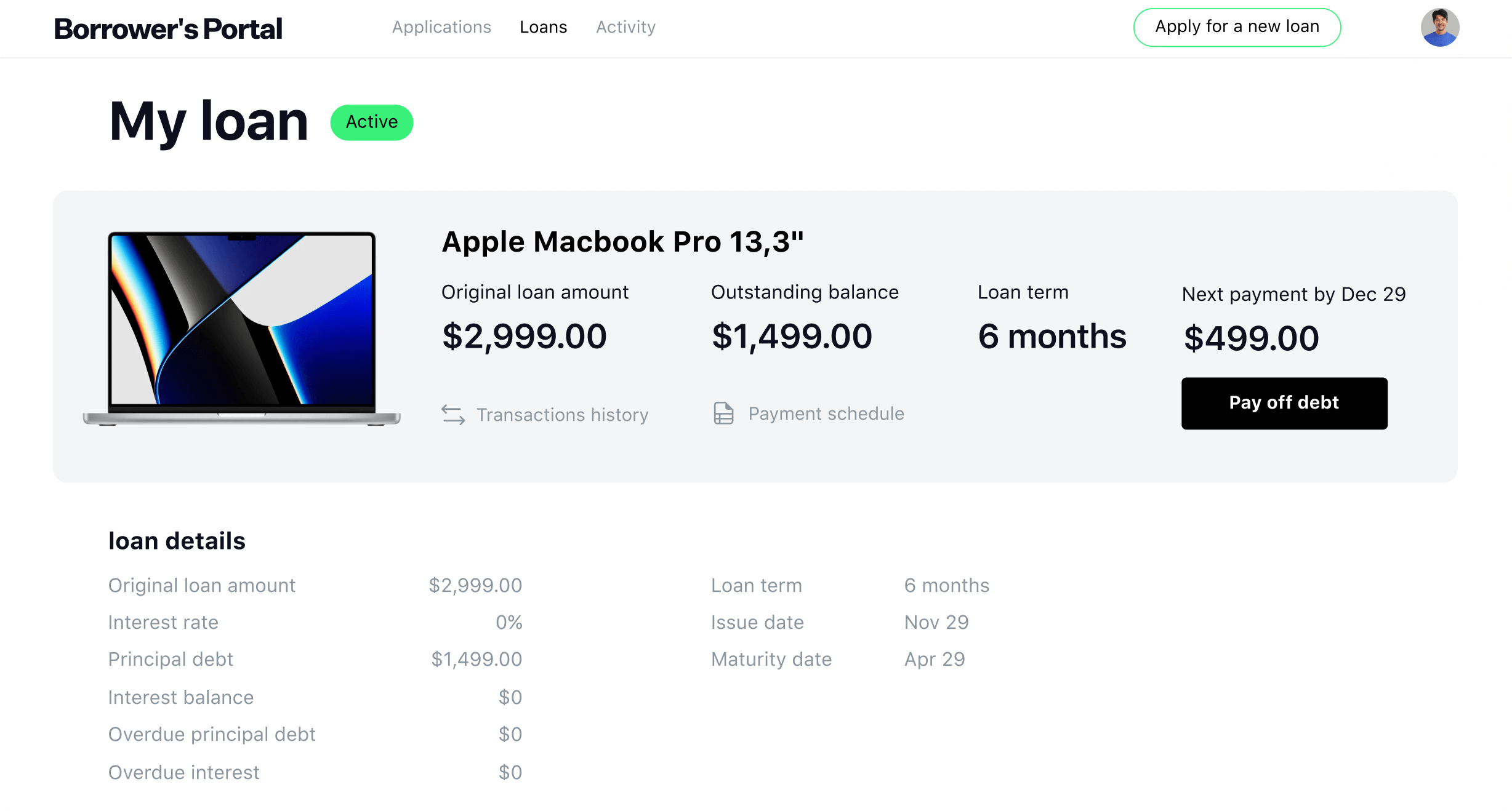

Fund Manager

The Fund Manager or loan processing manager provides the final stamp of approval on the loan application during the loan origination process. They are in charge of conducting site visits, assessing documentation of the Borrower, generating the loan agreement, facilitating e-signing between the Borrower and lender, and disbursing loans to the Borrower. Moreover, they ensure that the loan is processed according to the rules prescribed by the Federal Reserve Bank and does not follow any protocols. Throughout the loan lifecycle, the Manager monitors repayment and interest payments, ensuring that loans are closed as per the terms agreed upon by both parties.

Loans Provided through LOS

Personal Loans

Personal loans are acquired on credit from banks and fintech startups. Individuals apply for loans on the application for paying off credit card bills, student loans, daily expenses, and other utilities. Lenders can offer personal loans through loan originator software with flexible terms, competitive interest rates, and quick approval processes. Borrowers can access loans by filling out electronic forms, submitting required documentation digitally, and receiving funds directly into their bank accounts.

Small Business Loans

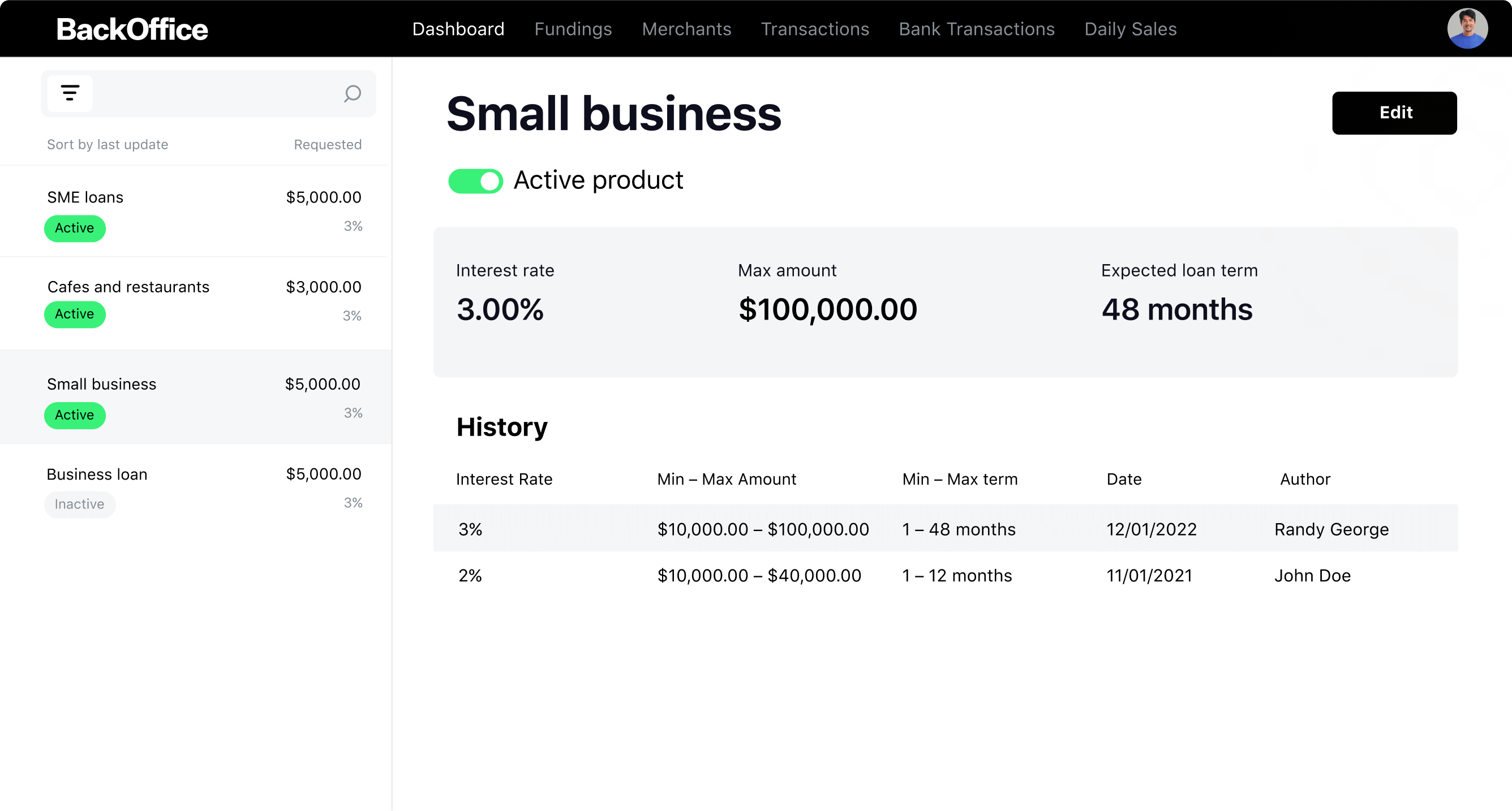

Small business owners form the cusp of employing a majority of the global workforce. They often face challenges in accessing capital from traditional lenders. Digital lenders can fill this gap by offering small business loans through LOS. They provide loans for undertaking debts, scaling units, investing in novel technologies, and hiring talented personnel. Loan origination software facilitates the process by streamlining business practices and gaining approval from credit agencies, insurance underwriters, and tax services.

Consumer Loans

Consumer lending options encompasses a diverse array of credit offerings, ranging from home loans to personal expense financing. They can be offered by private lenders through LOS. The process is simplified with a user-friendly interface for easy uploading of supportive documentation and interest rates as per their risk appetite. Customers benefit from convenient and affordable loan options tailored to their specific needs and financial conditions.

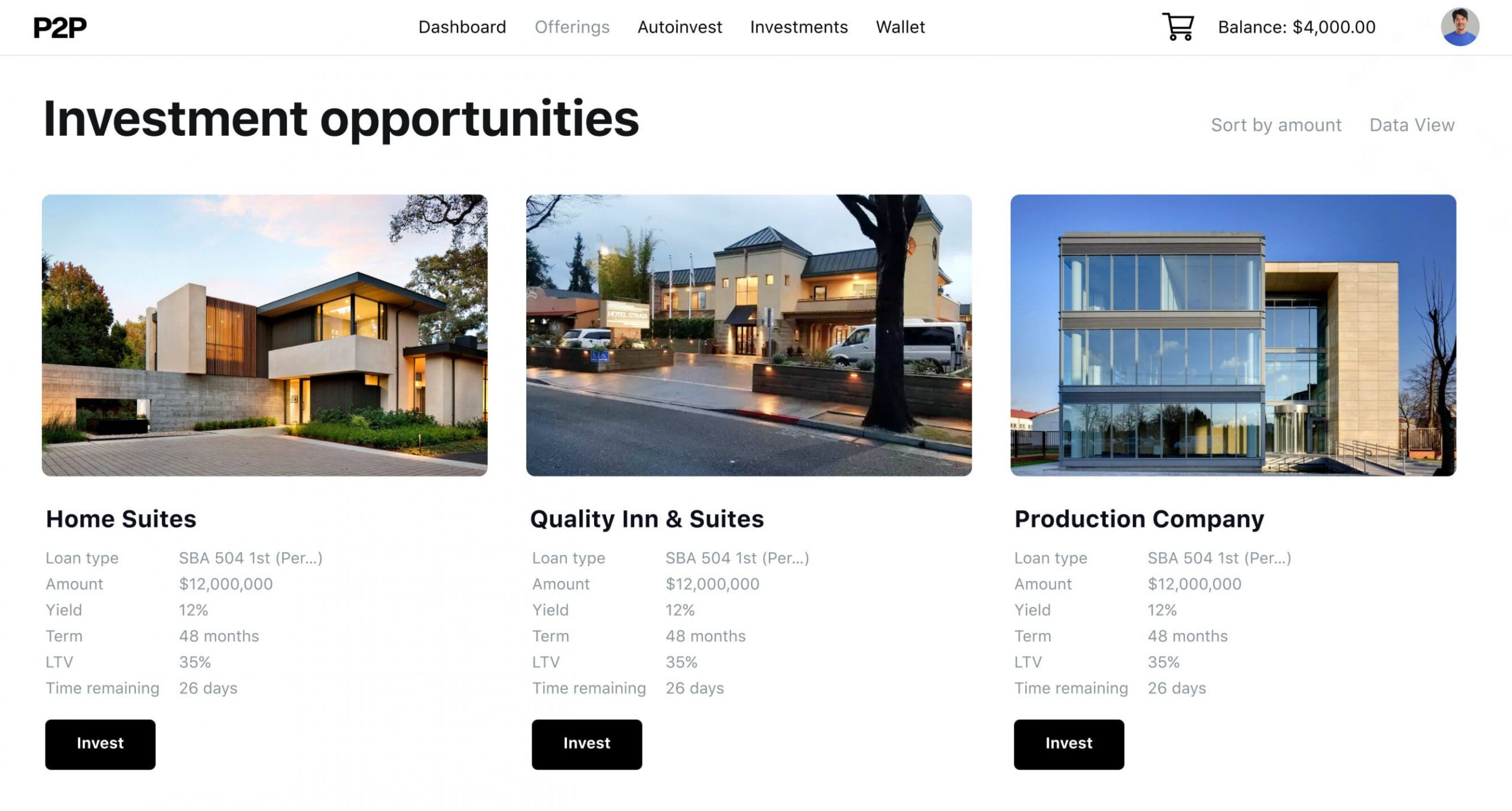

Peer-to-Peer (P2P) Loans

Peer-to-peer lending platforms connect Borrowers or enterprises looking for alternative financing options. The platforms stand as an online marketplace for Borrowers to choose funding from partners. They are matched with investors as per their credit rating score and customized lending options. In addition, security and safety standards are upgraded to ensure protection of user data.

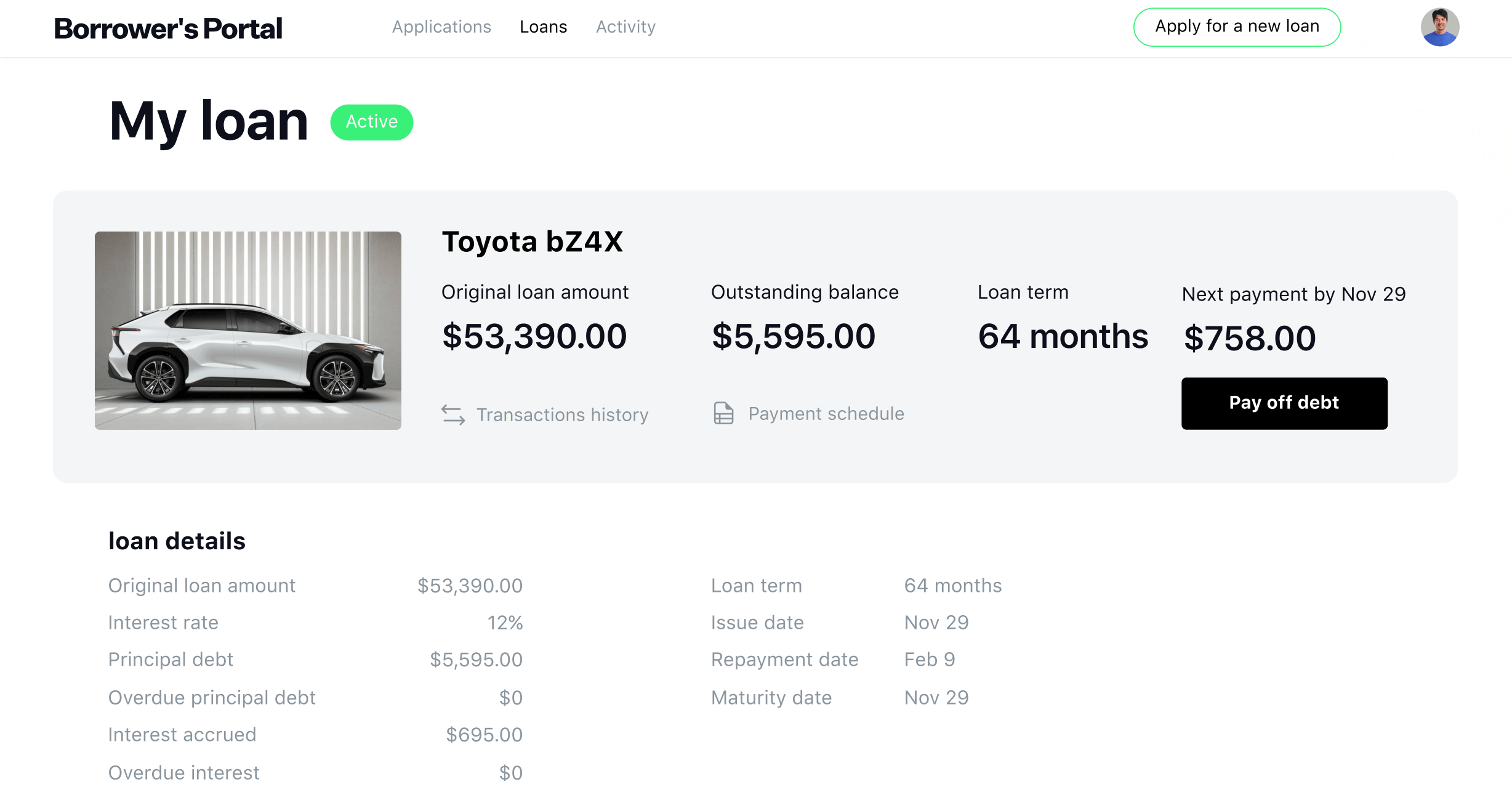

Vehicle Loans

Vehicle loans enable individuals to finance the purchase of all kinds of trucks, automobiles, and bikes. Fintech startups can offer vehicle loans through LOS by offering secured or unsecured loans. Lenders may provide loan options based on a customer’s credit score. Furnishing the required documents and papers of assets that may act as collateral in case the customer defaults on their loan can be programmed into the term sheet.

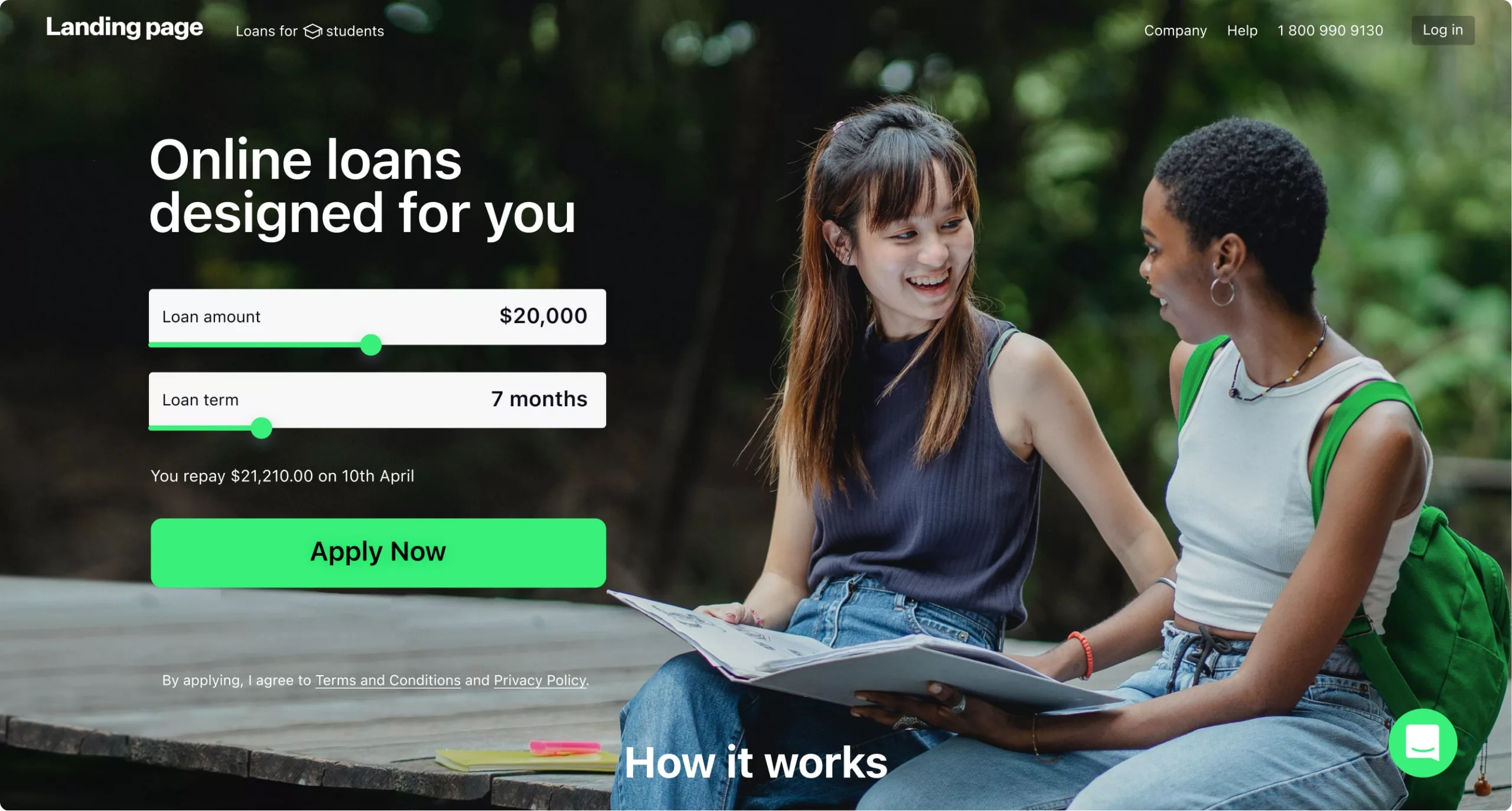

Student Loans

Student loans help students finance living expenses and pay for books and tuition. Fintech startups can offer student loans through LOS that meet their lending criteria. By leveraging data analytics to assess student creditworthiness and academic performance, fintech startups can offer personalized loans that help them make timely repayments and track their loan status on the website or mobile application.

Commercial and Industrial (C&I) Loans

Commercial and Industrial loans are provided to companies to meet their financing needs for various purposes such as expansion, streamlining processes, or working capital. Fintech startups can offer C&I loans through LOS with streamlined application processes, tailored lending solutions, and efficient funding mechanisms. They contribute to economic development and the growth of industries at large.

Revenue Generating Factors of LOS

The Loan Origination Software will assist in faster processing of loans and automation of manual processes, thereby providing lenders more profit-making opportunities.

Lucrative Revenue generating

Factors of Origination Software (LOS)

Commission for Booking

A Origination Software (LOS) should allow the admin to make a profit for each and every appointment booking happening on the platform. So, for every booking on the platform, Admin can get a certain commission percentage from it.

How useful was this Solution?

Click on a star to rate it!

Average rating 4.8 / 5. Vote count: 5

No votes so far! Be the first to rate this post.

How Can We Help?

Explore More Blogs

Digital Transformation

Top 10 Mobile App Development Frameworks in 2024

The mobile app development landscape is dynamic, with new frameworks and technologies emerging regularly. In

June 3, 2024

No Comments

Banking

Everything You Should Know About Loan Origination Software (LOS)

In today’s financial landscape, efficiency, accuracy, and customer satisfaction are paramount. One key technological advancement

May 22, 2024

No Comments

Digital Transformation

React 19 For Business: Latest Features and Updates

Websites have become highly dynamic. The static sites of lore had moving images and the

May 15, 2024

No Comments