Financial and banking services are important aspects of the financial system, and with the emergence of digital banking, there is a growing need for banking software development. Businesses throughout the world invest in smart AI-driven personalized banking solutions in order to enhance the customer experience, optimize operations, and stay competitive, whether they are international banks or small credit unions.

In the rapidly moving banking and financial sector, where billions of dollars change hands every millisecond, the importance of efficient software can’t be denied. Banking and finance are both driven by technology, so it’s no surprise that software development is a key part of resource management today. However, even if utilizing cutting-edge technology can provide significant benefits to organizations, it also poses new challenges. Financial leaders and professionals must collaborate to solve these challenges, which include keeping up with changing rules, automating operations, and staying ahead of the competition.

According to Grand View Research, the banking software industry worldwide is predicted to grow at a CAGR of 6.2% between 2022 and 2030. In 2022, the market was already worth $35.88 billion. Here are some of the key challenges in banking and financial software development.

Some of the Key Banking and Financial Software Development challenges include:

-

- Regulatory compliance

Keeping up with changing regulatory requirements is one of the most challenging software development tasks in finance and banking. With financial regulations continuously changing, it could be difficult for banks and financial organizations to stay relevant. This is likely to have a significant influence on corporate operations because noncompliance with the regulations can result in huge fines or even litigation. Banks need to invest in software solutions that enable them to stay compliant while also ensuring the security and efficiency of their systems.

-

- Security and Privacy

When it comes to the banking and financial sectors, ensuring the security of sensitive financial and personal data is critical. Financial institutions are a frequent target for hacking and financial crime.

It is a major challenge for organizations to handle security concerns in order to protect the data of their customers. It is important to have a response strategy in place in order to protect the IT infrastructure and customer data and avoid disruption.

The discontinuance of some financial information systems is one of the causes associated with increasing security threats.

The financial industry relies on cybersecurity to protect the security of its assets as well as the success of its operations. This has become more relevant in today’s interconnected and digitalized post-COVID world.

-

- System Integrations

Banking and finance must evaluate how their software solutions will connect with other IT systems within an organization or the networks of its partners. This requires the proper integration of various technologies and services in order to ensure data can be easily and safely transferred between multiple entities while maintaining consumer privacy. As a result, financial institutions ought to prioritize custom-built software solutions over off-the-shelf alternatives, which might or might not meet their goals or connect in a satisfactory way with current systems.

-

- Personalization

Customers want service providers to understand the unique requirements they have and provide solutions that are appropriate. As a result, the development of financial software with user-behavior analytics enables you to simply look at data and generate personalized solutions based on it.

-

- Scalability

While developing software solutions for financial and banking needs, scalability is critical. Financial organizations must take precautions in order to make sure that their IT infrastructure can serve an increasing number of users while maintaining its reliability and performance. Scalability must be built into custom software solutions from the start so that banks are well-prepared for any situation down the road that arises.

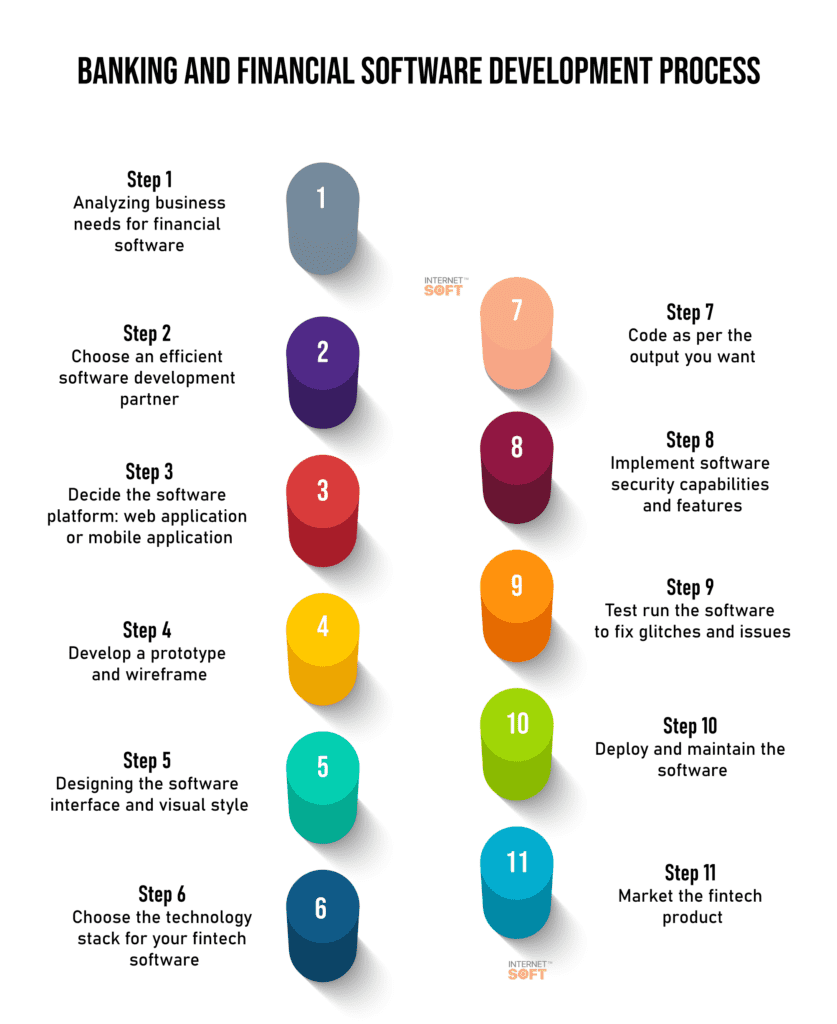

Must-Have Features in Banking and Financial Softwares

Before you begin developing banking and financial software for your company, you must first decide what features you want to include. While the list of features will differ based on the business model and the organization’s objectives, here are a few must-have features that you should consider for your banking and financial software.

-

- Well-Designed Dashboard

A control and monitoring system is a must for any data-driven software. A built-in dashboard can assist with this. A dashboard enables you to concentrate all transactional data—revenue, spending, market updates, and so on—in a simple, visible style

-

- Security Authentication

Security authorization is required for any financial web-based application. You can implement a multi-factor authentication solution to reduce cyber risks and ensure data protection.

-

- Payments and Financial Reporting

Payment is one of the most basic yet absolutely must-have features in financial software. Either you have a loan business model or a B2B company model, payments must be safe, practical, and real-time. You have the option of using bank-to-bank transfers, QR code payments, in-app wallet payments, and so on. With lots of data scattered around in the financial software database, it is also essential to add reporting capabilities that will aid in in-depth analysis and give beneficial insights to make better-informed decisions.

-

- CRM Capabilities and Third-Party Integrations

Customer relationship management (CRM) capabilities in banking and financial software are essential in order to maintain a healthy relationship with your customers. Also, third-party integrations in finance-related applications can help you combine the necessary tools with the correct API for adding additional capabilities.

Transform Your Banking Applications with Top-tier ReactJS Developers

Hire ReactJs Developer Hire Now for Seamless Innovation!

Cost of Banking and Financial Software Development

Financial software development can cost anything between $60,000 and $400,000. However, despite recognizing the needs of the financial industry, it might be difficult to provide a firm response.

The cost of financial software development is determined by factors such as the technology stack, third-party integrations, type of application, functionality, and so on.

Conclusion

Banking and financial software development needs robust security features, effective account management capabilities, interaction with third-party applications, and support for mobile and omnichannel. Software developers can build powerful and secure systems that meet the changing needs of banks and financial organizations while at the same time providing an exceptional customer experience.

Banking and financial software development involves meticulous planning as well as technical expertise. If you want to fulfill your idea of building a top-of-the-line core banking and financial software solution, then partnering with the most appropriate financial software development solution provider is critical.

Visit Internet Soft for the latest tech trends and insights around AI, ML, Blockchain, along with NeoBanking and timely updates from industry professionals!

Need assistance or have questions? Reach out us at sales@internetsoft.com.