The banking industry is experiencing a major shift towards automation with the advent of RPA (Robotic Process Automation). RPA in banking enables financial institutions to automate manual processes, reduce costs, increase efficiency and improve customer service. By utilizing the power of RPA, banks can streamline banking processes, eliminating mundane tasks, and freeing up employees to focus on more complex tasks. In this blog post, we’ll discuss the potential of RPA in banking, and how it can revolutionize the banking industry by streamlining banking processes.

Understanding the Challenges in Banking Processes

Automation in Banking has brought about numerous benefits and improvements in the industry. However, it also comes with its fair share of challenges. Understanding these challenges is crucial in order to effectively implement RPA and maximize its potential in streamlining banking processes.

One of the main challenges in automation in banking is the complexity of the existing processes. Banking processes are often intricate and involve numerous steps, approvals, and interactions with different systems. Implementing automation in such processes requires a thorough understanding of the existing workflows and a careful mapping of the automation steps. This can be time-consuming and requires significant coordination between different teams within the bank.

Another challenge is the integration of automation with legacy systems. Many banks still rely on older systems that are not easily compatible with modern automation technologies. Integrating RPA with these legacy systems can be complex and require extensive customization. Additionally, data security and compliance issues need to be carefully addressed to ensure that customer information is protected.

Automation in banking also presents challenges related to employee engagement and change management. While automation can eliminate mundane and repetitive tasks, it may also lead to concerns about job security among employees. Banks need to effectively communicate the benefits of automation to their employees and provide them with opportunities for upskilling and reskilling. Employee resistance to change can slow down the implementation process and hinder the full potential of RPA.

Lastly, scalability is a significant challenge in implementing automation in banking. As banks grow and expand their operations, the automation solutions need to be able to handle increased volumes of transactions and processes. This requires careful planning and scalability of the automation infrastructure.

What is RPA and How it Works?

Robotic Process Automation (RPA) is a cutting-edge technology that uses software robots or "bots" to automate repetitive and rule-based tasks in banking processes. These bots mimic human actions by interacting with various systems, applications, and databases, allowing for seamless integration and efficient processing.

So, how does RPA actually work? Let’s dive in!

Firstly, RPA bots can be programmed to perform a wide range of tasks, from data entry and document processing to account reconciliation and compliance checks. These bots can work across multiple systems simultaneously, accessing and extracting data, performing calculations, and executing transactions. They can even communicate with other bots or human operators if necessary.

To initiate an RPA process, a trigger is required. This trigger could be a time-based event, such as a scheduled task, or it could be event-driven, meaning it is activated by a specific action or input. Once the trigger is activated, the bot starts executing the predefined steps of the process.

RPA bots are capable of working with structured and unstructured data, meaning they can extract information from documents, emails, and other sources without the need for manual intervention. They can also make decisions based on predefined rules or algorithms, allowing for automation of complex processes.

One of the key benefits of RPA is its ability to integrate with existing systems and applications. This means that banks can leverage their existing IT infrastructure without the need for extensive customization or system replacements. RPA bots can interact with legacy systems, web-based applications, databases, and APIs, allowing for a seamless integration of automation into the existing banking processes.

Moreover, RPA is a scalable technology, meaning that banks can easily scale up or down their automation efforts based on their needs. As the volume of transactions or processes increases, more bots can be deployed to handle the workload. This scalability ensures that banks can keep up with the growing demands of their customers while maintaining high levels of efficiency and accuracy.

In summary, RPA is a game-changer in the banking industry. It allows for the automation of repetitive tasks, streamlining banking processes, reducing errors, and improving efficiency. With its ability to integrate with existing systems and scale up or down as needed, RPA is revolutionizing the way banks operate and paving the way for a more automated and customer-centric future.

Streamlining Banking Processes with RPA Automation is revolutionizing the financial sector. By integrating cutting-edge technology like Machine Learning Development Services, banks are enhancing efficiency, accuracy, and customer experiences. Discover how this synergy is reshaping the way banking works, setting a new standard for innovation.

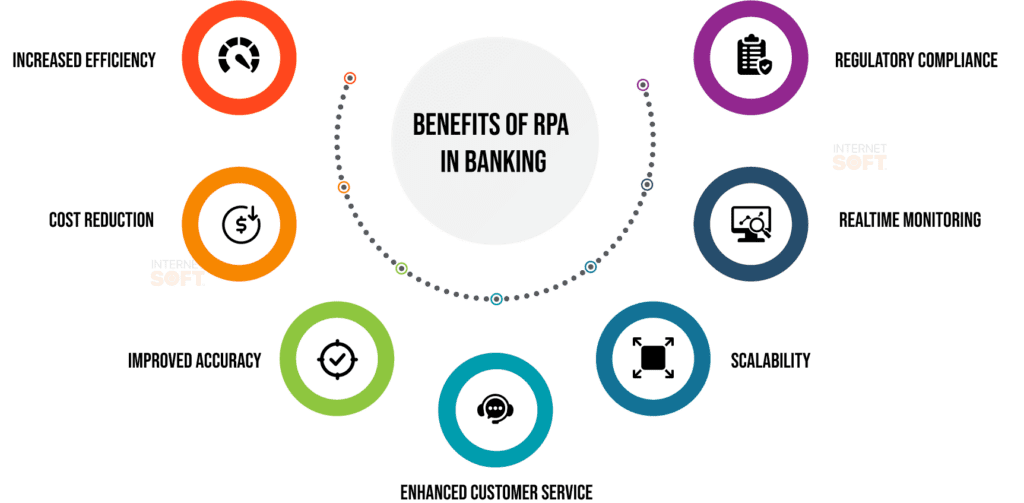

Benefits of RPA in Banking

In today’s fast-paced banking industry, efficiency and cost-effectiveness are paramount. That’s where RPA comes in. Robotic Process Automation (RPA) offers numerous benefits for banks looking to streamline their processes and enhance customer service. Let’s take a closer look at some of the key benefits of RPA in banking.

1. Increased Efficiency: RPA enables banks to automate repetitive and rule-based tasks, reducing the time and effort required to complete them manually. This increased efficiency allows employees to focus on more complex tasks that require human judgment and critical thinking.

2. Cost Reduction: By automating manual processes, banks can significantly reduce operational costs. RPA eliminates the need for hiring additional staff to handle mundane tasks, ultimately saving the bank money in the long run.

3. Improved Accuracy: Human errors can occur, especially when dealing with repetitive tasks. RPA ensures a higher level of accuracy by minimizing manual intervention and reducing the risk of errors. This is particularly important in processes that require compliance and regulatory adherence.

4. Enhanced Customer Service: With RPA, banks can improve their customer service by reducing response times and enhancing accuracy in transactions. RPA bots can quickly process customer requests, leading to faster resolution times and improved customer satisfaction.

5. Scalability: RPA allows banks to scale their automation efforts as their operations grow. Whether it’s an increase in the volume of transactions or expanding into new markets, RPA can handle the increased workload without compromising efficiency.

6. Real-time Monitoring and Reporting: RPA provides real-time monitoring and reporting capabilities, allowing banks to track and analyze process performance. This enables proactive identification and resolution of any issues, leading to continuous process improvement.

7. Regulatory Compliance: RPA ensures compliance with regulatory requirements by automatically following predefined rules and regulations. Banks can rest assured that their processes are aligned with industry standards and guidelines.

In summary, RPA offers numerous benefits for the banking industry. By automating manual tasks, banks can achieve increased efficiency, cost reduction, improved accuracy, enhanced customer service, scalability, real-time monitoring, and regulatory compliance. Implementing RPA allows banks to streamline their processes and position themselves at the forefront of innovation in the ever-evolving banking landscape.

Examples of RPA Implementation in Banking Processes

The implementation of RPA (Robotic Process Automation) in banking processes has gained significant momentum in recent years, with numerous success stories emerging from financial institutions across the globe. In this section, we will explore some real-life examples of RPA implementation in banking processes, showcasing how this innovative technology has revolutionized the way banks operate and deliver services to their customers.

One notable example of RPA implementation in banking is in the area of customer onboarding. Traditionally, the process of onboarding new customers involved extensive paperwork, manual data entry, and verification. However, with the introduction of RPA, banks have been able to automate this process, significantly reducing the time and effort required. RPA bots can extract customer information from various sources, perform due diligence checks, and populate the necessary forms automatically. This not only expedites the onboarding process but also ensures accuracy and compliance with regulatory requirements.

Another area where RPA has made a significant impact is in mortgage loan processing. The loan approval process in banking often involves gathering and analyzing large volumes of data from multiple sources, including credit bureaus, income verification systems, and property appraisal databases. By leveraging RPA, banks can automate the collection and analysis of this data, enabling faster loan processing and reducing the chances of errors or discrepancies. RPA bots can access these systems, extract the necessary information, perform calculations, and generate reports, all within a fraction of the time it would take a human employee to complete the same tasks.

Fraud detection and prevention is yet another area where RPA has proven to be highly effective. Banks face the constant challenge of detecting and preventing fraudulent activities, which can have a significant impact on their financial health and reputation. RPA bots can continuously monitor transactions, identify suspicious patterns or behaviors, and trigger alerts or investigations in real-time. This proactive approach to fraud detection not only enhances the bank’s ability to mitigate risks but also helps to safeguard the interests of their customers.

Want to Supercharge your GO application?

Hire Golang Developer now and unlock the potential of your GO apps.

Key Considerations for Implementing RPA in Banking

As the banking industry embraces the power of Robotic Process Automation (RPA), it’s important to consider some key considerations before implementing this revolutionary technology. Here are some factors that financial institutions should keep in mind when incorporating RPA into their banking processes.

Firstly, a thorough analysis of existing processes is essential. Before implementing RPA, banks should conduct a comprehensive assessment of their current workflows to identify the most suitable processes for automation. This will help determine the areas where RPA can have the greatest impact and yield the highest returns. By focusing on processes that are repetitive, rule-based, and time-consuming, banks can optimize the implementation of RPA and ensure a smooth transition.

Another consideration is the level of scalability required. As banks grow and expand their operations, it’s important to choose an RPA solution that can scale accordingly. This means selecting a technology that can handle increasing volumes of transactions and processes without compromising efficiency. Banks should work closely with their RPA provider to ensure that the solution can grow alongside their business needs.

Furthermore, data security and compliance should be at the forefront of any RPA implementation. Banks deal with sensitive customer information on a daily basis, so it’s crucial to ensure that the automation solution meets strict security and compliance requirements. Implementing measures such as encryption, access controls, and regular security audits will help protect customer data and maintain regulatory adherence.

Employee engagement and change management are also key considerations. As automation takes over repetitive tasks, it’s important to communicate the benefits of RPA to employees. Providing training and upskilling opportunities will not only alleviate concerns about job security but also enable employees to take on more value-added roles. This will ultimately enhance the implementation process and maximize the benefits of RPA.

Finally, collaboration between different teams within the bank is crucial. Implementing RPA involves coordination between various departments, including IT, operations, and compliance. It’s essential to establish effective communication channels and foster collaboration to ensure a seamless integration of RPA into existing processes.

By taking these key considerations into account, banks can successfully implement RPA and revolutionize their banking processes. With careful planning, scalability, data security, employee engagement, and collaboration, financial institutions can streamline their operations, enhance customer service, and position themselves at the forefront of innovation in the banking industry. The potential of RPA in banking is vast, and by addressing these considerations, banks can fully harness its power for success in the digital era.

Visit Internet Soft for the latest tech trends and insights around AI, ML, Blockchain, along with NeoBanking and timely updates from industry professionals!

Need assistance or have questions? Reach out us at sales@internetsoft.com.