The Core Banking System is the backbone of any business venture in the world of today. Without an effective core banking system, the economy of any business may be hampered a lot.

Internet Soft, a leading software development company in California, is all set to deliver core banking system solutions for its customers with a high degree of expertise and development knowledge. Internet Soft offers the latest banking features in line with the market for customers.

To learn more about Core Banking Systems by Internet Soft, visit the website or contact immediately on the given numbers on the website.

As a leading Banking software development company, Internet Soft initiates a rapid working model for customers with efficient development. We have had successful Projects over the years in the Banking domain for Core Banking Systems, as we are an established software provider for the banking sector.

Let’s continue with the changes:

What Are Core Banking Systems?

Core Banking Systems are the centralized structures that enable banks to manipulate their maximum essential operations, such as deposits, loans, mortgages, and bills. These systems combine diverse banking modules to offer a comprehensive platform for dealing with each retail and company banking function.

With Core Banking Systems, banks can automate habitual tasks, streamline workflows, and gain insights into purchaser behavior, permitting them to tailor services and products to meet evolving needs efficiently.

Unlock the power of Node.js expertise for your projects

Hire Node.js Developers today!

Internet Soft’s Core Banking Solution is designed to address the evolving wishes of monetary institutions in a modern-day digital landscape. Here’s how it may advantage your corporation:

- Streamlined Operations: Internet Soft’s answer automates ordinary banking duties, lowering manual attempts and growing operational performance. From account control to transaction processing, the device streamlines workflows to ensure clean operations across all departments.

- Enhanced Customer Experience: With Internet Soft’s Core Banking Solution, banks can offer customers seamless Digi travel. The platform helps multi-channel banking, allowing clients to get the right of entry to offerings via cell apps, net banking portals, and ATMs. Features like real-time account updates and personalized hints beautify purchaser satisfaction and loyalty.

- Scalability and Flexibility: As banks develop and adapt to converting market dynamics, they need a Core Banking System that can scale alongside their business. Internet Soft’s answer is rather scalable, allowing banks to enlarge their operations without compromising performance. Additionally, the device gives flexibility via customizable modules and configurations tailor-made to every group’s specific necessities.

- Robust Security: In an era of increasing cyber threats, security is paramount for monetary institutions. Internet Soft’s Core Banking Solution contains advanced security functions to shield touchy facts and save you from unauthorized admission. From encryption protocols to multi-issue authentication, the gadget guarantees the integrity and confidentiality of client information.

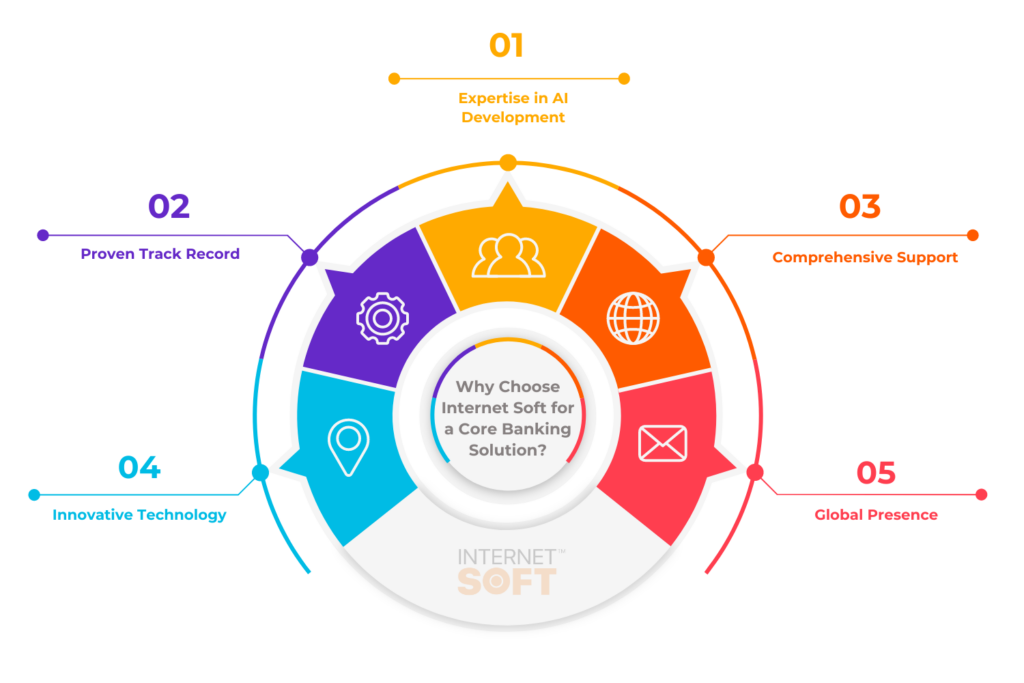

Why Choose Internet Soft for a Core Banking Solution?

Expertise in AI Development: Internet Soft is at the forefront of AI improvement, leveraging present-day technologies to decorate its Core Banking Solution. By harnessing the electricity of artificial intelligence, the company promises wise insights and predictive analytics that empower banks to make statistics-pushed selections and force enterprise increase. With a team of skilled AI engineers and fact scientists, Internet Soft ensures that its Core Banking Solution remains at the leading edge of innovation, constantly evolving to satisfy the changing desires of the monetary enterprise.

Proven Track Record: With years of experience inside the enterprise, Internet Soft has hooked up itself as a dependent-on partner for banks searching for modern generation solutions. The company’s tune record of hit implementations and happy customers speaks volumes about its dedication to excellence and consumer pride. Internet Soft understands the demanding situations going through banks today and has a confirmed potential to supply tailor-made answers that deal with particular ache points and drive tangible consequences.

Comprehensive Support: Internet Soft gives comprehensive aid during the implementation system and past. From initial consultation to ongoing preservation and updates, the enterprise’s dedicated team of professionals is there to ensure a clean transition and the best overall performance of the Core Banking Solution. Internet Soft is aware that enforcing a new Core Banking System can be a frightening undertaking for banks, and it strives to make the system as seamless and hassle-loose as possible, presenting steering and support every step of the manner.

Innovative Technology: Internet Soft is dedicated to staying ahead of the curve concerning technological innovation. The enterprise invests heavily in studies and development to ensure that its Core Banking Solution stays at the slicing fringe of technology. From blockchain integration to device studying algorithms, Internet Soft incorporates contemporary improvements into its platform to offer banks the equipment they need to achieve today’s virtual panorama. By choosing Internet Soft’s Core Banking Solution, banks can destiny-evidence their operations and stay ahead of the competition.

Global Presence: With an international presence spanning a couple of continents, Internet Soft has the know-how and sources to assist banks of all sizes, from small network banks to large multinational agencies. The corporation understands the particular challenges and regulatory necessities dealing with banks in distinctive regions and may tailor its Core Banking Solution to satisfy nearby desires. Whether a financial institution operates in North America, Europe, Asia, or the past, Internet Soft has the understanding and experience to help it achieve a modern-day aggressive market.

Conclusion

Core Banking Systems are crucial in the modern banking environment, enabling monetary institutions to function effectively and deliver extraordinary customer reviews. Internet Soft’s Core Banking Solution stands out as a complete and revolutionary platform that empowers banks to thrive in the latest virtual world. With its consciousness of scalability, flexibility, safety, and AI-pushed insights, Internet Soft is the right accomplice for banks seeking to harness the energy of generation to drive growth and achievement.

As an AI Development Company and Software Development Company in California, Internet Soft combines information with innovation to supply world-magnificence answers that exceed expectations. By selecting Internet Soft’s Core Banking Solution, banks can future-proof their operations and stay ahead of the competition in an ever-evolving enterprise.

Visit Internet Soft for the latest tech trends and insights around AI, ML, Blockchain, along with NeoBanking and timely updates from industry professionals!

Need assistance or have questions? Reach out us at sales@internetsoft.com.

ABOUT THE AUTHOR

Abhishek Bhosale

COO, Internet Soft

Abhishek is a dynamic Chief Operations Officer with a proven track record of optimizing business processes and driving operational excellence. With a passion for strategic planning and a keen eye for efficiency, Abhishek has successfully led teams to deliver exceptional results in AI, ML, core Banking and Blockchain projects. His expertise lies in streamlining operations and fostering innovation for sustainable growth