Fraud is evolving faster than ever. From financial transactions and digital payments to insurance claims and eCommerce activities, fraudsters continuously adapt their tactics to bypass traditional rule-based systems. Static fraud detection methods can no longer keep up with the scale, speed, and sophistication of modern fraud.

AI in fraud detection enables organizations to move from reactive fraud prevention to proactive, real-time risk intelligence. By leveraging machine learning, behavioral analytics, and pattern recognition, businesses can detect anomalies early, reduce false positives, and protect revenue without disrupting customer experience.

In this blog, we explore how AI is transforming fraud detection, key use cases, and best practices for implementation.

Why Traditional Fraud Detection Falls Short?

Legacy fraud detection systems rely heavily on predefined rules and historical patterns. While effective in the past, they struggle with modern, dynamic fraud scenarios.

Common limitations include:

- High false-positive rates

- Delayed fraud identification

- Inability to adapt to new fraud patterns

- Poor scalability with transaction growth

- Limited real-time decision-making

AI addresses these challenges by learning continuously and adapting to new threats as they emerge.

How AI Transforms Fraud Detection?

AI-powered fraud detection systems analyze vast volumes of structured and unstructured data in real time to identify suspicious behavior.

AI enables:

- Continuous learning from new fraud patterns

- Behavioral analysis instead of static rules

- Real-time transaction monitoring

- Improved accuracy with fewer false alerts

- Faster response and mitigation

This makes AI an essential layer in modern risk and compliance strategies.

1. Real-Time Transaction Monitoring

AI models evaluate transactions as they happen, reducing the window of opportunity for fraud.

Key capabilities include:

- Monitoring high-volume transactions in real time

- Identifying abnormal spending or access patterns

- Flagging suspicious activities instantly

- Supporting automated approval or rejection

This is especially critical for banking, fintech, and digital payment platforms.

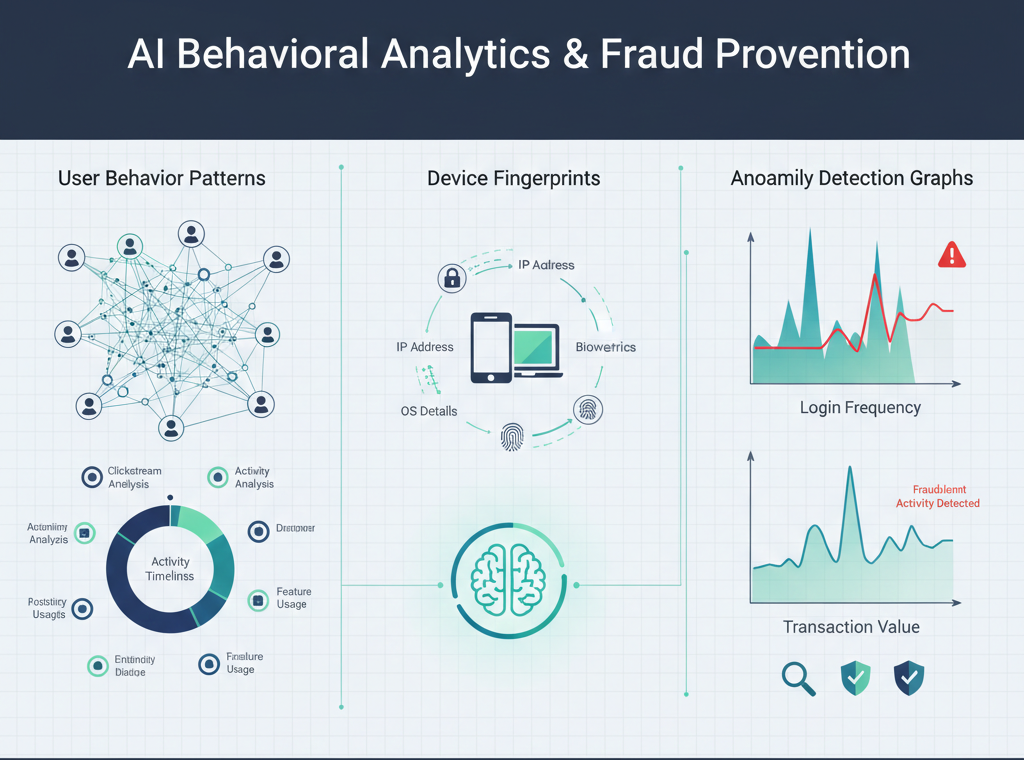

2. Behavioral Analytics and Anomaly Detection

Fraud often hides within seemingly legitimate activity.

AI analyzes behavioral signals such as:

- Login frequency and device usage

- Transaction velocity and timing

- Geographic and network anomalies

- User interaction patterns

By understanding “normal” behavior, AI can quickly detect deviations that indicate fraud.

3. Reducing False Positives with Machine Learning

False positives lead to poor customer experiences and operational inefficiencies.

AI improves accuracy by:

- Learning from historical fraud outcomes

- Continuously refining risk scores

- Adapting to customer behavior changes

- Prioritizing high-risk alerts for investigation

This ensures legitimate users are not unnecessarily blocked or challenged.

4. AI in Identity and Account Takeover Prevention

Account takeover (ATO) attacks are increasing across industries.

AI helps prevent ATO by:

- Detecting suspicious login behavior

- Identifying bot-driven attacks

- Monitoring device and session fingerprints

- Triggering adaptive authentication mechanisms

This layered approach strengthens digital identity security.

5. Fraud Detection Across Industries

AI-powered fraud detection is widely adopted across sectors:

Common use cases include:

- Banking and financial services fraud

- Insurance claims fraud

- eCommerce and payment fraud

- Healthcare billing and claims fraud

- Telecom subscription and usage fraud

AI’s adaptability makes it effective across diverse fraud scenarios.

6. Integrating AI with Existing Risk Systems

AI delivers the most value when integrated with enterprise systems such as:

- Core banking and payment platforms

- CRM and customer identity systems

- Risk and compliance tools

- Security and monitoring platforms

Seamless integration ensures AI insights are actionable and operationalized in real time.

Conclusion

AI in fraud detection enables organizations to stay ahead of evolving threats while minimizing customer friction. By leveraging real-time analytics, behavioral modeling, and continuous learning, AI-driven systems significantly improve fraud detection accuracy and response speed. Companies that invest in AI-powered fraud prevention gain stronger security, lower losses, and improved trust with customers.

Looking to enhance your fraud prevention strategy with AI-driven intelligence?

- Connect us – https://internetsoft.com/

- Call or Whatsapp us – +1 305-735-9875

ABOUT THE AUTHOR

Abhishek Bhosale

COO, Internet Soft

Abhishek is a dynamic Chief Operations Officer with a proven track record of optimizing business processes and driving operational excellence. With a passion for strategic planning and a keen eye for efficiency, Abhishek has successfully led teams to deliver exceptional results in AI, ML, core Banking and Blockchain projects. His expertise lies in streamlining operations and fostering innovation for sustainable growth